Proud signatories of the UN’s Six Principles for Responsible Investment

Our Business

We back growing mid-market businesses in Central Europe

Accession Capital Partners (ACP), formerly known as Mezzanine Management, pioneered private debt in Central Europe in 2000 and has since evolved to become a one-stop-shop for growth capital to mid-market businesses. We have successfully invested over EUR 1 billion across five funds, helping regional businesses grow organically and through acquisition; domestically and abroad.

We started out providing mezzanine finance alongside financial sponsors. The region has grown a lot since then, and so have we: today we provide all types of funding depending on what best suits a particular business at a specific point in its development. Nowadays half of our deals are done alongside a financial sponsor; the other half sees us providing a single-institution solution to growing businesses.

While a lot has changed in 24 years, a lot has stayed the same – namely our relationship-based approach. Being first-to-market means we have the experience to truly understand the markets which has made us a ‘preferred partner’ for regional financial sponsors and advisory firms.

Our People

An experienced, stable and motivated team of seasoned investment specialists

Our team comprises eighteen investment professionals across five regional offices. The team has developed unrivalled business and financial networks across the region, enabling a wide ranging proprietary deal flow for our clients as well as coverage of the spectrum of commercial and financial activity in the region.

Franz Hoerhager

Founding Partner & ChairmanVienna

Przemyslaw Glebocki

Managing Partner, CIOWarsaw

Chris holds a Bachelor degree in banking & finance from Loughborough University and a diploma in Marketing from the Chartered Institute of Marketing (UK).

Chris Buckle

Partner, CROVienna / Prague

Since joining Accession Capital Partners in 2008, Piotr participated and has been responsible for investments in a Polish road maintenance company, IT equipment distributor, telecommunication company in Bulgaria, international capital goods producer, Poland’s leading car leasing company, consumer finance businesses in the region and commercial cooling equipment producer. Piotr started his career at Ernst & Young Poland.

Piotr graduated from the faculty of Quantitative Methods and Information Systems at the Warsaw School of Economics. He also pursued a study program at the Stockholm School of Economics.

Piotr Sadowski

Partner, Head of Baltic RegionWarsaw

Before joining Accession Capital Partners in 2010, Christian worked as Associate at M Cap Finance, a Frankfurt-based mid-market mezzanine fund. His key responsibilities included assessment of deals, financial modelling, due diligence and structuring of transactions. Christian started his career at Unicredit’s Markets and Investment Banking division focusing on transactions in Austria and CEE.

Christian holds a Masters Degree from the University of Economics and Business Administration in Vienna.

Christian Stix

Partner, Head of Investor RelationsVienna

Before joining ACP in 2019, Marko focused on restructurings and special situations, working in most countries of Central and Southeast Europe as well as in the United States, most recently at the European Bank for Reconstruction and Development. During his career, Marko also served as CEO and CFO in companies with EUR 50-200 million in revenues.

A graduate of City University, Marko has written a book about restructuring and is a member of the International Insolvency Institute.

Marko Mitrovic

Partner, Head of Balkans & BulgariaVienna

Jakub joined Accession Capital Partners from Bridgepoint, a leading European mid-cap fund where he spent over 6 years, covering the CEE region and working on a variety of projects. Prior to that he worked at Enterprise Investors, a leading CEE-focused fund. His sector experience is particularly strong in the consumer as well as business services space.

Prior to his first role in private equity, Jakub worked for Ernst & Young Corporate Finance.

Jakub graduated from faculty of Finance and Banking at the Warsaw School of Economics.

Jakub Chechelski

PartnerWarsaw

Prior to joining Accession Capital Partners Monika cooperated with Enterprise Investors, a leading CEE-focused private equity fund, where she spent 15 years working on a variety of projects in various sectors. Prior to her first role in private equity, Monika worked in credit risk departments of Raiffeisen Bank and Fortis Bank (today BNP Paribas).

Her sector experience is particularly strong in the specialty retail, e-commerce, healthcare, financial services and FMCG. Monika graduated from faculty of Finance and Banking at the Warsaw School of Economics.

Monika Rogowska

Investment PartnerWarsaw

Before re-joining ACP in 2020 Laszlo started his own SME-focused business support venture. During his earlier tenure at ACP, he looked after transactions in Hungary and in the Western Balkan. Laszlo sources investment opportunities in Hungary. He is a passionate volunteer of good causes.

Laszlo has obtained a MBA degree from the US. Besides the Weatherhead School of Management Laszlo attended INSEAD’s and CEU’s Business Administration master programs.

Laszlo Olah

Director Budapest

Dmytro is a graduate of Lviv Polytechnical University with a Master’s degree in Management.

Dmytro Kistechko

Investment ManagerWarsaw

Karol holds a Masters degree from the University of Economics in Poznan, Bachelor with Honours degree from the Abertay University and pursued study programs at the Harvard University.

Karol Kaminski

Investment ManagerWarsaw

Radana comes from Slovakia and holds Master degree in Law from Comenius University in Bratislava. .

Radana Cheret

Investor Relations and Head of ESGVienna

Nick holds Master’s degree in finance from ESSEC Business School (Paris, France) and a Bachelor’s degree in General Management from the EBS Business School (Frankfurt, Germany).

Nikolaus Labak

Investment Manager Vienna

Originally from Slovenia, Nika pursued her BSc in Economics and Business, graduating with honours and a double degree from Kyungpook National University in South Korea. Post graduation she worked as a Business Development Manager in a fast-growing, early stage InsureTech start-up.

Nika holds an international MSc in Management from Catolica Lisbon School of Business and Economics.

Nika Hribernik

Investment Associate Vienna

Irena is a graduate of chemical engineering from AGH University in Cracow, and holds a Master degree in Finance and Accounting from the Warsaw School of Economics.

Irena Dobrowolska

Investment AssociateWarsaw

Prior to joining Accession Capital Partners on a permanent basis he successfully completed a professional internship at the firm’s Warsaw office. He is responsible for the analysis and screening of potential investment opportunities, as well as for devising business strategies to support portfolio companies in achieving their performance objectives.

Artur holds a Bachelor of Business Administration degree from the Schulich School of Business in Toronto, and a Master of Finance degree from the Lviv Polytechnic National University.

Artur Rusiyan

AnalystWarsaw

Between 2014 and 2019, Paul worked as a senior reporting manager at a private equity fund administrator across the Channel Islands, Luxembourg and Sweden, managing client reporting requirements as well as being responsible for technical accounting matters and quality control.

Prior to 2014, Paul worked in Financial Services Audit in Guernsey for Ernst & Young for six years.

Paul is a Certified Charted Accountant (FCCA) and holds a Physics degree from the University of Leicester.

Paul Moss

Chief Financial Officer Vienna

With over a decade of invaluable experience gained in both Luxembourg and the UK, Iain's tenure at esteemed administration firm Aztec Group underscores his expertise and dedication to our mission.

Iain is a Certified Chartered Accountant (FCCA) and holds a degree in Accounting & Finance from the Robert Gordon University.

Iain Smith

Finance DirectorLuxembourg

Ludwig Henckel

Investor Relations Vienna

Our Funds

Accession Capital Partners is a pioneering, independent investment advisory firm, with a focus on Central Europe. Funds we advise provide tailored financing solutions to established mid-market businesses and small and medium enterprises. Accession Capital Partners helped to create and now advises five successful mezzanine funds: Accession Mezzanine Capital I, II, III as well as Accession Capital Partners IV & V.

Regional Expertise

Central Europe – Europe’s fastest growing region

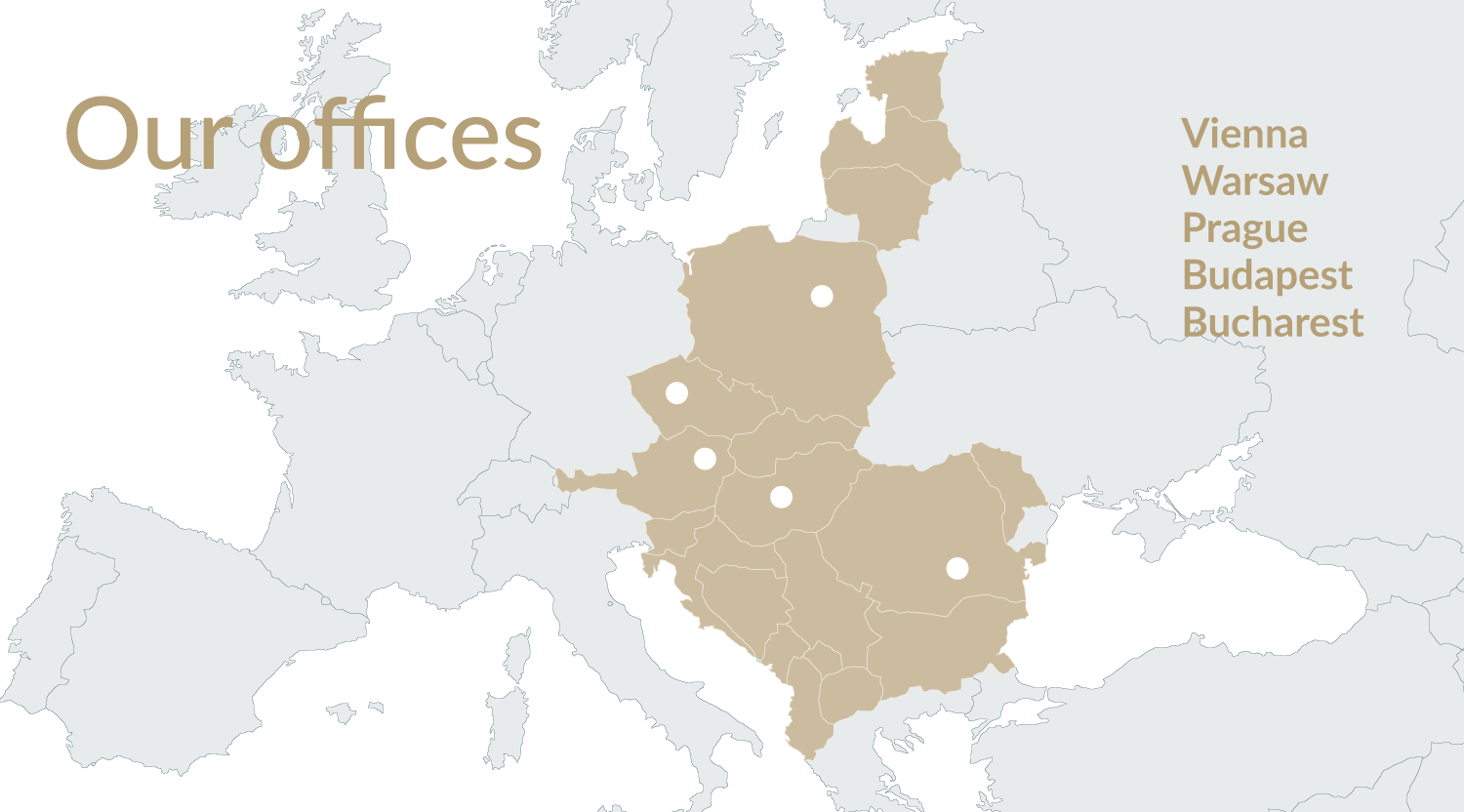

During our 20+ years of investing experience in the region, our Group has become the regional leader in Alternative Financing. With 5 country offices, the breadth of our coverage is our forte.

Warsaw

Accession Capital Partners sp.z o.o

Zlota 59, 00-120 Warsaw, Poland

Tel: +48 22 654 6415

Fax: +48 22 654 6415

Prague

Accession Capital Partners s.r.o.

ArchiHUB, Puskinovo namesti 681|3, 160 00 Prague 6 - Bubenec, Czech Republic

Tel: +420 605 737052

Fax: +43 1 532 899020

Vienna

Accession Capital Partners GmbH

Kohlmarkt 5/6, 1010 Vienna, Austria

Tel: +43 1 532 8990

Fax: +43 1 532 899020

Budapest

Accession Capital Partners Hungary

Károly körút 5/a, 1075 Budapest, Hungary

Tel: +36 (30) 303 6781

Fax: +36 1 475 1111

Bucharest

Accession Capital Partners Romania

40 Pictor Barbu Iscovescu Street, second fl. 011938 Bucharest 1st district, Romania

Tel: +40 21 230 3219

Fax: +40 21 230 3226

A convergence play

We advised on mezzanine and associated private equity investments in countries which acceded to the European Union in 2004 and 2007, and we have a regional presence in Central and Eastern Europe for over 20 years.

Reasons for growth finance in Central Europe

Three equally important factors qualify the need for growth finance in Central Europe:

- Improved macroeconomic, regulatory, and legal framework in Central Europe which allows for strong growth, even in a difficult global market environment

- The region is underserved by traditional lenders, as Basel III regulations have had a negative effect on bank preparedness to lend generally, and to mid-caps in particular, therefore opening space for alternative capital providers

- A funding gap resulting from a limited number of dedicated non-bank providers of non-equity term finance for growing companies

Response to the scarcity of classical funds

Investments are well differentiated across sectors within the region. Anticipating the growing opportunity for high-grade investments along with regional convergence, the credibility and demand for private debt will correlate in growth. This will occur – particularly as other sources of financing temporarily withdraw from the market or contract as a result of the financial crisis – and as the availability of increasingly attractive pricing is realised from an improved risk/return profile.

Local know-how

Doing business in a fragmented region comprising numerous countries, languages, legislations, economic frameworks and currencies such as Central Europe, requires the utmost dedication and expertise. The cumulated experience of our team provides for a structured business approach, and a long-term growth perspective.